Irs Gift Tax Form 2025. Annual gift tax exclusion increase: To estimate how many americans still need to file their taxes for the 2025 tax season, we can use the total number of returns received by the irs as of march 15 (71.5 million) and compare it to.

The gift tax applies to the transfer by gift of any type of property. In 2025, you can give gifts of up to $18,000 to as many people as you want without any tax or reporting requirements.

Starting from calendar year 2025, the annual exclusion for gifts will increase to $18,000, up from $17,000 in 2025.

Irs Gift Tax Return 2025 Devin Feodora, All federal offices, including the irs, will be closed. Starting from calendar year 2025, the annual exclusion for gifts will increase to $18,000, up from $17,000 in 2025.

IRS Form 709 Gift Tax Return to Download in PDF, Filing the form with the irs is the responsibility of the giver, but it’s only required in certain gift giving situations. Gifts in other cases are taxable.

3.11.106 Estate And Gift Tax Returns 397, In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). The faqs on this page provide details on how tax reform affects estate and gift tax.

Federal Gift Tax Form 709 Gift Ftempo ED4, For the year 2025, the irs sets specific limits on the amount that can be given to any number of individuals without incurring a gift tax or even needing to file a gift tax return. Starting from calendar year 2025, the annual exclusion for gifts will increase to $18,000, up from $17,000 in 2025.

Federal Gift Tax Form 709 Gift Ftempo ED4, The tax is based on the value of the gift. Starting from calendar year 2025, the annual exclusion for gifts will increase to $18,000, up from $17,000 in 2025.

Irs Gift Letter Sample My XXX Hot Girl, The income tax department periodically updates tax return forms to gather additional information from taxpayers. If you exceed the annual gift tax limit (also known as the annual gift tax exclusion), you must file a gift tax return with the irs to report it.

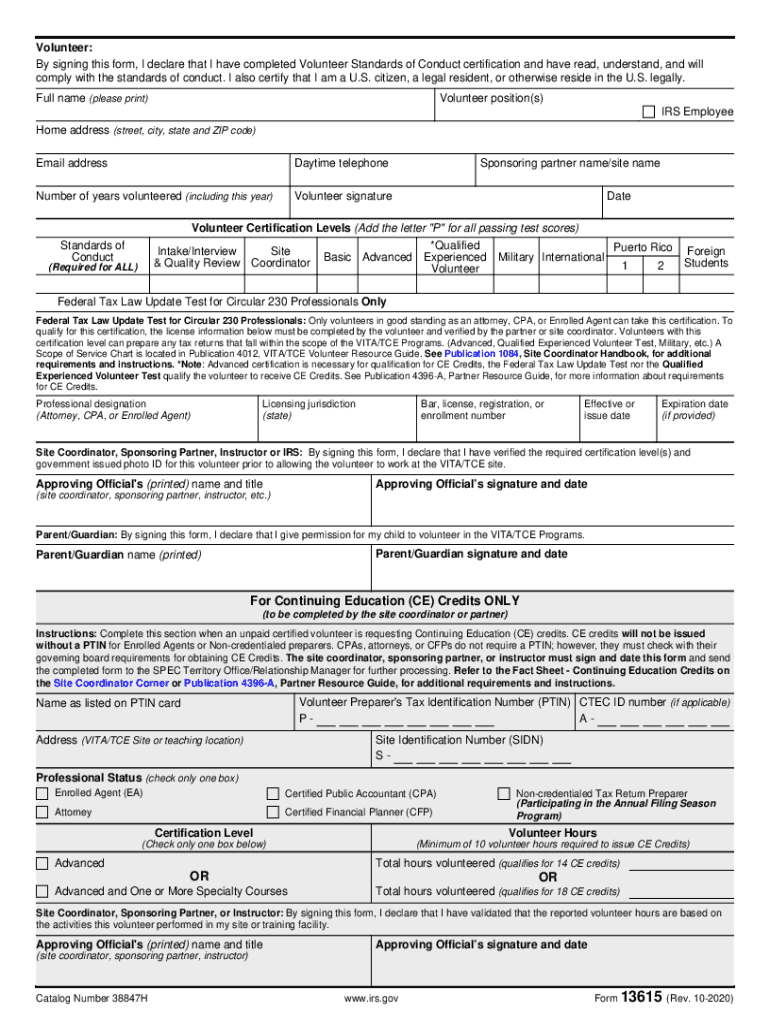

Volunteer Agreement PDF 20202024 Form Fill Out and Sign Printable, The united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2025. Take for instance the check grandma writes for your birthday each year.

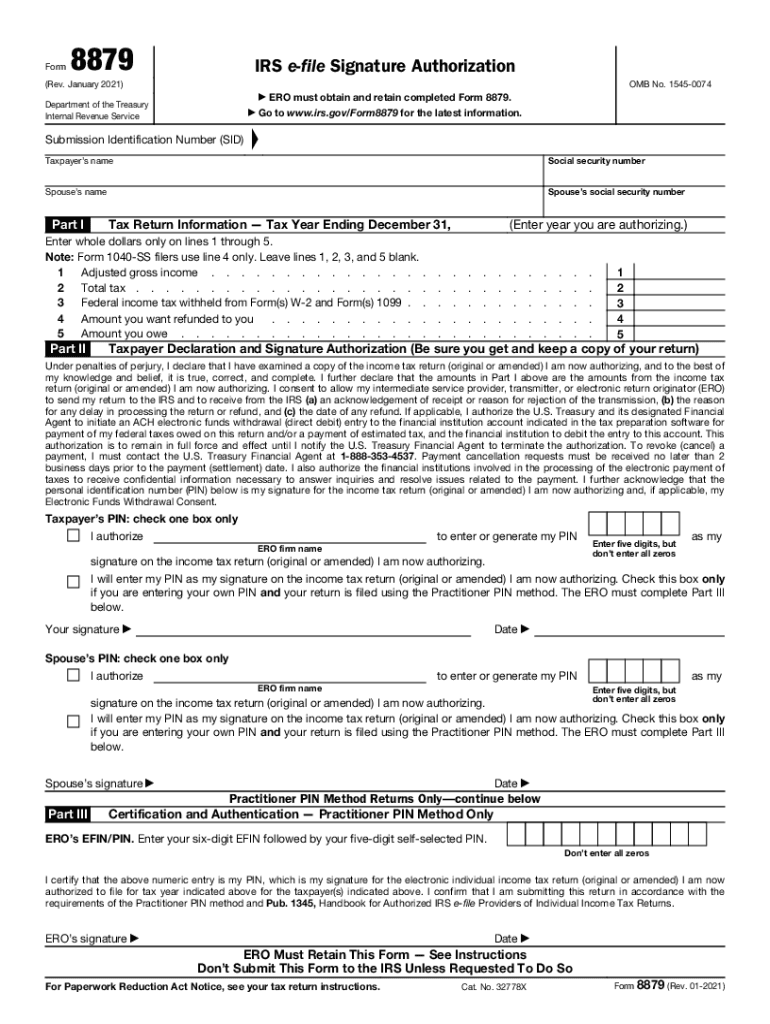

8879 Latest 20212024 Form Fill Out and Sign Printable PDF Template, To estimate how many americans still need to file their taxes for the 2025 tax season, we can use the total number of returns received by the irs as of march 15 (71.5 million) and compare it to. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return.

Federal Gift Tax Form 709 Gift Ftempo ED4, Limits on annual gift tax exclusion 2025. The gift tax is applicable when you receive nothing in exchange, or receive compensation that’s less than the property's full value.

3.11.106 Estate And Gift Tax Returns 397, In 2025, the gift tax limit was $17,000 per individual. This adjustment allows individuals to gift up to $18,000 per recipient without triggering any gift tax liability.

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return.